A liberal group’s TV spot features a working mother who says she’s like “Warren Buffett’s secretary” and pays higher tax rates than “many billionaires and millionaires.” Not quite. With her $40,000 income and three kids, she’d actually pay a far lower rate than Buffett says he paid on his income. So, she’s not like his secretary. Furthermore, her rate would also be lower than the rate paid by the vast majority of those making more than $1 million a year.

The truth is that — on average — high-income taxpayers pay higher rates than those in the middle, or at the bottom for that matter. But you would never know that from this ad released by MoveOn.org Civic Action. The ad appeared on CNN and MSNBC starting Sept. 22. It was keyed to a White House push to get Congress to adopt the “Buffett rule” — the principle that “no household making over $1 million annually should pay less in federal taxes than middle-class families pay.” But the ad presents an inaccurate picture of how the tax burden is really shared.

It shows actors playing an office worker, a man who could be a security guard or police officer, and the fictional working mother dressed in blue scrubs, perhaps intended to represent a worker in a doctor’s office. They all say, “I’m Warren Buffett’s secretary” — a reference to the billionaire investor’s statement that he pays a lower tax rate than his secretary and others who work in his office.

It’s true that some very high-income people may well pay lower tax rates than the fictional $40,000-a-year mom, if we count the Social Security and Medicare taxes she pays — and also count the payroll taxes paid by her employer on her behalf. That’s the way Buffett figures that he paid only 17.4 percent, and that the 20 others who work in his office paid an average of 36 percent.

But the working mom in the ad would have paid just 9.2 percent on her 2010 income. And she’ll pay an even lower rate on this year’s income — 7.8 percent — which is less than half the rate Buffett says he paid.

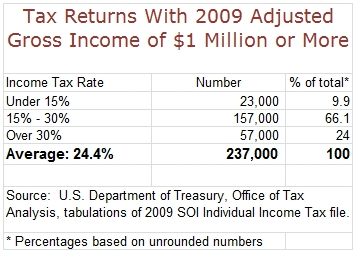

How does that compare to those of “billionaires and millionaires”? To get a rough idea, we’ll compare her total rate with a breakdown of income-tax rates paid by persons reporting adjusted gross income of $1 million or more in 2009,  from a table supplied by Obama’s Treasury Department in support of his “Buffett Rule” proposal. What this breakdown shows is that the average tax rate for these returns was 24.4 percent. Adding payroll taxes would push that rate a bit higher, but the administration didn’t estimate those. Even so, the average income-tax rate paid by those whose income was $1 million or more is more than two-and-a-half times higher than the rate that would have been paid by MoveOn’s fictional working mother in income taxes and direct and indirect payroll taxes combined.

from a table supplied by Obama’s Treasury Department in support of his “Buffett Rule” proposal. What this breakdown shows is that the average tax rate for these returns was 24.4 percent. Adding payroll taxes would push that rate a bit higher, but the administration didn’t estimate those. Even so, the average income-tax rate paid by those whose income was $1 million or more is more than two-and-a-half times higher than the rate that would have been paid by MoveOn’s fictional working mother in income taxes and direct and indirect payroll taxes combined.

The administration’s figures also show that less than 1 in 10 of these high-income taxpayers paid less than a 15 percent income-tax rate. So it follows that an even smaller percentage would have paid a combined income/payroll tax rate that’s lower than what MoveOn’s mom would have paid.

We asked Daniel Mintz, campaign director for MoveOn.org Civic Action, to comment on our findings. He said: “Many millionaires and billionaires pay a lower tax rate than many middle-class families. Whether it’s thousands of millionaires or just hundreds, if even one millionaire pays a lower tax rate than a middle class mother of three, that’s one too many.” He said that “those who’ve done well in this country” should pay “their fair share.”

We of course take no position on the “Buffett rule” or whether anyone’s rate should be higher or lower. What’s “fair” is a subjective matter, and we try to stick to facts. But the fact is, MoveOn’s ad presents a misleading picture.

Technical Notes

MoveOn’s mom is the only one in the ad who mentions her income, so we have no way to calculate tax rates for the other two. She tells us: “I have three kids, make $40,000 a year, and I contribute a greater percentage of my income than many billionaires and millionaires.” But using the tax calculator on H&R Block’s website, we figure that she would have paid zero federal income tax on her 2010 income — and gotten refund payments from the government of $2,148. Since she used the first person singular and mentions her “kids” but no spouse, we assume she’s single and filing as head of household. We also assume her “three kids” are all under age 17 and thus qualify for the per-child tax credit.

That refund would have offset about a third of all her Medicare and Social Security payroll taxes, which would come to $3,060 paid directly by her plus $3,060 paid on her behalf by her employer. Since we count the taxes paid by her employer (as Buffett does) as being paid indirectly by her, we must also count those taxes as indirect income to her, in order to calculate her overall tax rate properly. On that basis her direct and indirect income would have been $43,060 and her net federal taxes (all payroll taxes less her income tax refund) would have come to $3,972, for a rate of 9.22 percent.

Her rate for 2011 would be even lower. She would lose the benefit of the expiring “Making Work Pay” tax credit but benefit from this year’s temporary cut in payroll taxes. She would get a federal income tax refund totaling $1,944, according to the Tax Foundation’s tax calculator. Subtracting that from all the payroll taxes she and her employer would pay, we get combined payroll/income tax of $3,376, and a rate of 7.84 percent.

— Brooks Jackson

Correction, Oct. 6: We mistakenly wrote that the mom in the ad said she pays “lower tax rates” than millionaires and billionaires. That should have been “higher tax rates,” and we have corrected the error.