In promoting his own spending priorities, President Joe Biden blamed his predecessor’s “unpaid tax cuts and other spending” for increasing the national debt by nearly $8 trillion over four years. The total debt figure is correct, but trillions of that were due to bipartisan coronavirus relief packages.

Biden made the criticism of former President Donald Trump in an Aug. 11 speech about Biden’s “Build Back Better” plan. He said the $3.5 trillion budget resolution, which the Senate approved the same day Biden spoke, was the framework for his plan.

Many of the details on the spending and funding for the budget still need to be written in separate legislation, but some of the major initiatives include child care, health care, universal pre-K, free tuition at community colleges and efforts to combat climate change, according to a Senate memo giving instructions to the committees drafting the bill.

In his speech, Biden said the 10-year budget resolution would be “fully paid for over the long term” through increased taxes on large corporations and “the super wealthy.” He claimed the plan would “actually reduce the national debt … over the long run,” but that remains to be seen. And he claimed Trump’s tax and spending priorities were fiscally irresponsible.

“This isn’t going to be anything like my predecessor, whose unpaid tax cuts and other spending added nearly $8 trillion in his four years to the national debt. Eight trillion dollars,” Biden said.

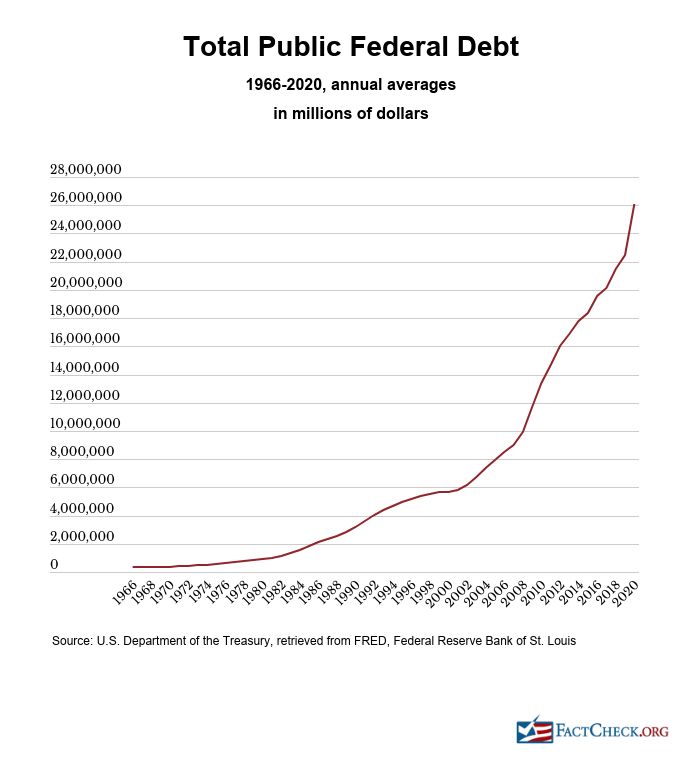

The total national debt did go up by $7.8 trillion during Trump’s four years. It rose from nearly $20 trillion the day Trump was inaugurated to nearly $27.8 trillion on the day he left office.

That figure, however, includes money the U.S. owes to itself. We typically use figures for the amount of debt held by the public, which went up by $7.2 trillion during Trump’s time in office. Debt held by the public went up by $8.1 trillion during the eight years of former President Barack Obama and Vice President Biden.

A ProPublica/Washington Post story published Jan. 14 noted that Trump had promised to reduce the debt, and instead legislation he signed added substantially to it, including the 2017 tax cut law.

The GOP tax law was supported only by Republicans using the same reconciliation process that the Democrats now want to use to avoid a Republican filibuster to pass the $3.5 trillion spending bill with only Democratic votes.

“One of President Donald Trump’s lesser known but profoundly damaging legacies will be the explosive rise in the national debt that occurred on his watch,” the news organizations wrote. “The financial burden that he’s inflicted on our government will wreak havoc for decades, saddling our kids and grandkids with debt.”

But not all of that debt can be pinned solely on the former president. In fact, a lot of it had bipartisan backing, including trillions in coronavirus relief legislation, which was supported by Democrats as well as Republicans.

Under the U.S. Constitution, it takes Congress — not merely a president’s actions — to draft and pass legislation that would add to the debt. And measuring the increase over four years in office, as Biden does in his claim, isn’t the best way to assess the impact of an administration, Marc Goldwein, senior vice president and senior policy director for the Committee for a Responsible Federal Budget, told us. A better measure is to look at what legislation the president signed into law and what impact those new laws would have.

For one, the debt added during a president’s term includes the impact of actions that predate the administration. In January 2017, the month Trump took office, the nonpartisan Congressional Budget Office was already estimating a budget deficit of $559 billion for fiscal 2017, with hundreds of billions in yearly deficits each year thereafter, reaching a trillion-dollar deficit in 2023.

The outlook worsened under Trump. By January 2020, before the coronavirus pandemic hit the U.S., the CBO estimated the 2019 deficit would be close to a trillion, with $1-trillion-plus yearly deficits projected each subsequent year over the 10-year outlook.

A major culprit is the GOP tax cuts, enacted in late 2017. They significantly reduced government revenues. Goldwein estimated the tax cut law could account for about $1 trillion of the debt increase during the Trump years. But the impact of the law extends well beyond that, if Congress doesn’t change it. The CBO estimated the 2017 tax law would add $1.9 trillion to yearly deficits over a 10-year period.

In his Aug. 11 remarks, Biden said, “They didn’t even purport to try to pay for their tax cuts, which went straight to the largest corporations and the wealthiest Americans.” It’s true the tax cuts weren’t paid for, but they didn’t only benefit the wealthy. (As we’ve explained, about a quarter of the benefits of the law would go to the top 1% of income earners by 2025; that bumps up to 83% of the benefits in 2027 because the bulk of the individual income tax cuts are set to expire by then.)

Trump also signed — but with Democratic support — bipartisan budget acts for 2018 and 2019 that “dramatically increased discretionary spending” and mostly weren’t paid for, Goldwein said.

By September 2020, CRFB estimated the legislation and executive actions signed by Trump would be responsible for $3.9 trillion in higher deficits through 2026. The bulk of that — $2.3 trillion — was attributed to lowering taxes, while increases in defense and veterans spending ($950 billion) and nondefense discretionary spending ($700 billion) made up the rest. “It is important to note that this debt was also approved by Congress, about half on a broad, bipartisan basis,” CRFB said.

Then came the coronavirus pandemic, which reduced government revenues and increased spending on unemployment benefits. Congress then passed, and Trump signed, several pieces of legislation to help the nation cope with the economic and public health challenges of the pandemic.

The ProPublica/Washington Post report estimated more than $3 trillion went to COVID-19 relief spending, which economists agreed was necessary to bolster the economy, the news outlets reported.

“The combination of Trump’s 2017 tax cut and the lack of any serious spending restraint helped both the deficit and the debt soar,” the story said. “So when the once-in-a-lifetime viral disaster slammed our country and we threw more than $3 trillion into COVID-19-related stimulus, there was no longer any margin for error.”

Still, out of all of these impacts on the debt, “only one is sort of purely on Republicans,” Goldwein said. That’s the tax cuts.

Similarly, debt will increase under Biden but some of the causes will be bipartisan measures or external factors beyond a president’s control.

“We’re going to have a lot more debt over the next four years,” Goldwein told us. But “a lot of that is not going to be President Biden’s fault.”

Editor’s note: FactCheck.org does not accept advertising. We rely on grants and individual donations from people like you. Please consider a donation. Credit card donations may be made through our “Donate” page. If you prefer to give by check, send to: FactCheck.org, Annenberg Public Policy Center, 202 S. 36th St., Philadelphia, PA 19104.