President Donald Trump has repeatedly questioned the economics of wind energy, saying that wind “doesn’t work” without subsidies. Experts have differing assessments of that.

In the U.S., subsidies have played an important role in building the wind industry, which has grown from supplying almost none of the nation’s electricity in 2000 to almost 7% in 2018. But when it comes to how reliant the industry is on subsidies today, analysts disagree.

By some metrics, wind power is already competitive with fossil fuels without extra financial help. But other measures don’t reach the same conclusion — and projections vary about what will happen to the industry when its biggest subsidy goes away.

The president’s latest comments on wind power subsidies came in a June 29 press conference in Japan during the Group of 20 summit. At the G20, the U.S. inserted language into the leaders’ declaration reiterating its intention to withdraw from the Paris Agreement.

The president’s latest comments on wind power subsidies came in a June 29 press conference in Japan during the Group of 20 summit. At the G20, the U.S. inserted language into the leaders’ declaration reiterating its intention to withdraw from the Paris Agreement.

The remaining 19 countries, in contrast, reaffirmed their commitment to the accord. Citing the U.S.’s unique position on the issue, a journalist asked the president why he thinks ignoring climate change would be beneficial to Americans.

Trump denied ignoring the issue, and defended his position by asserting, as he has before, that the U.S. has the “cleanest air” — as well as the cleanest air and water “we’ve ever had.”

As we’ve explained previously, the U.S. does not have the cleanest air in the world. Moreover, what’s important with respect to climate change are greenhouse gas emissions, which remain high.

After mentioning clean air and water, Trump then turned his attention to wind turbines.

Trump, June 29: It doesn’t always work with a windmill. When the wind goes off, the plant isn’t working. It doesn’t always work with solar, because solar is just not strong enough.

And a lot of them want to go to wind, which has caused a lot of problems. And, you know, the problem with wind is, in the United States, we’re subsidizing these wind towers all over the place because wind doesn’t work — for the most part, doesn’t work without subsidy. And I don’t want to be subsidizing things that don’t have to be subsidized.

The United States is paying tremendous amounts of money on subsidies for wind. I don’t like it. I don’t like it. I don’t want to do that.

Trump’s fascination with wind subsidies is not new. In an October 2018 meeting with workers about government regulation, for instance, he said of wind and solar, “if you don’t give them a subsidy, they don’t work. … They need massive subsidy.”

And back in April 2012, he said in testimony before the Scottish Parliament, “By the way, many countries have decided that they do not want wind, because it does not work without massive subsidies.”

That was part of Trump’s long — and ultimately unsuccessful — opposition to a wind farm being built near his Trump International Golf Links course.

Setting aside that Trump’s latest comments argue the case from both sides — that wind both needs and doesn’t need a subsidy — whether wind “works” without a subsidy is a surprisingly difficult question to answer.

In a certain way, it’s unknowable — the U.S. is currently subsidizing wind, so it’s hard to say what would happen to the market were the subsidy not there. Still, there are several different ways of tackling the question, but even using similar methods, different groups come up with different answers.

We’ll review the subsidies the wind industry receives and explain why assessing wind’s competitiveness isn’t as straightforward as it might seem.

Wind Subsidies

The primary federal subsidy for wind is a tax credit known as the production tax credit, or PTC, which offers wind facilities and some other renewables a small tax credit for every kilowatt hour of energy produced over a farm’s first decade.

According to the Joint Committee on Taxation, U.S. support of wind through the PTC has amounted to at least $1 billion every fiscal year since 2010, including estimates of $4.5 billion in 2018 and $4.7 billion in 2019, or a total of just under $25 billion since 2010.

The credit, however, is already being phased out. After being worth a maximum of 2.3 cents per kWh for farms that broke ground in 2016, the credit value has fallen by 20 percentage points each year, and the PTC is scheduled to elapse entirely at the beginning of 2020. This year is the last year in which wind operators can begin building a new wind farm and receive a tax credit going forward.

There are other federal subsidies that go to wind power, including about $24 million for research and development in 2016, per the Energy Information Administration. But as a University of Texas at Austin Energy Institute analysis found, the vast majority of federal investment in wind stems from the PTC.

Outside of federal subsidies, wind benefits from a bevy of state policies and incentives, most notably through renewable portfolio standards, which require a certain amount of electricity to be generated by renewable sources.

While the standards are not subsidies in the traditional sense, multiple experts said they function like subsidies and have driven wind development in areas where it otherwise would not have happened. As the tax credit goes away, these standards are likely to play an even bigger role.

The financial impacts of these policies, however, are difficult to tabulate, and most analyses that provide estimates of wind energy costs with a breakdown without subsidies are only concerned with the financial assistance coming from the PTC.

It should be noted that other forms of energy also receive subsidies. “Every energy technology we’ve had … has benefited quite substantially from the federal government,” said Jay Bartlett, a senior research associate at the independent nonprofit Resources for the Future.

Natural gas and oil producers, for instance, receive tax preferences for exploration and development costs, and receive additional tax breaks related to extraction, among others.

According to reports from the Department of Energy and the Congressional Research Service, fossil fuels have historically received more support than renewables, but in recent years the trend has flipped — and on a per unit of energy basis, renewables currently receive far more. Because many of the renewable tax subsidies are set to expire, the CRS report estimates that fossil fuels will receive more tax benefits than renewables in 2028.

Greenhouse gas emissions are also not currently factored into the costs of various forms of energy. Instead, lawmakers have generally opted for subsidies for energy sources that have lower carbon footprints, including wind.

“We subsidize because they’re emerging tech we care about, and by doing so we can lead them down this path to lower costs,” said Bartlett.

Short of a tax on carbon, Bartlett said subsidies are an “imperfect, but at least somewhat reasonable way to reward the non-carbon emitting element of wind or solar power.”

The Classic Method: Levelized Cost

With those caveats in mind, we’ll turn to one of the most common approaches of assessing cost competitiveness of various electricity sources: a measure called levelized cost of electricity, or LCOE.

According to the Energy Information Administration, the idea behind LCOE is to estimate all of the costs involved in building and operating a generating plant over its lifetime — from upfront capital and financing costs to fuel and maintenance costs — relative to the amount of electricity produced.

“It’s basically saying, if you wanted to build a new plant, what would you build?” explained Brian Murray, an energy policy economist at Duke University, in a phone interview. Since it represents a cost, lower values are better and indicate more competitiveness.

By this metric, several energy firms find that even without subsidies factored in — meaning without the PTC — building a new onshore wind farm is already cheaper than, or within range of, building a new fossil fuel-fired plant.

Bloomberg New Energy Finance, for instance, shared its latest unsubsidized midpoint levelized cost figures with us. Wind just edged out combined cycle gas turbine plants, coming in at $37 versus $38 per megawatt hour. And wind was well under coal’s $78 per megawatt hour.

In a statement, BloombergNEF wind analyst Rachel Shifman noted that by 2030, “it will even be cheaper to build new wind farms than to run existing gas or coal plants in much of the U.S.” That’s a higher bar than the new-to-new comparison, since it’s much cheaper to keep a plant going than to factor in construction.

Lazard, an investment bank that has been calculating LCOE values for 12 years running, estimated in November 2018 that unsubsidized wind costs between $29-$56 per MWh, compared with $41-$74 for natural gas and $60-$143 for coal. With subsidies, wind became even more attractive, falling to just $14-$47 per MWh.

Lazard’s analysis also suggests that without subsidies, building a new wind farm in some scenarios is approaching cost-competitiveness with running existing coal and nuclear plants.

“In terms of coal, new wind is definitely cheaper in terms of building a new unit, and may even be cheaper than continuing to operate a coal plant that has already been built,” said Murray.

But not everyone comes up with such generous levelized cost estimates for wind — and there are limitations to using LCOE.

The EIA, which produces LCOE figures for future years, estimated in February that for wind facilities coming online in 2021, the average cost without subsidies would be $48.80/MWh when weighting by capacity. That’s compared with $46.70 for conventional natural gas and $40.50 for advanced natural gas (see Table A1a).

Unsubsidized LCOE Estimates

| BloombergNEF midpoint 2019 value |

EIA average (capacity-weighted) in 2021 |

Lazard 2018 ranges |

|

| Onshore wind | $37/MWh | $48.80/MWh | $29-56/MWh |

| Natural Gas | $38/MWh | $40.50/MWh for advanced; $46.70/MWh for conventional | $41-74/MWh |

| Coal | $78/MWh | N/A | $60-143/MWh |

| Note: This table is for summary purposes only, and is meant to show the wide range of different results that can occur when groups are making different assumptions. Cost estimates are for new power plants only. Experts caution that different sets of LCOEs cannot be directly compared, and as we explain, there are challenges in comparing intermittent sources, such as wind, to baseload sources, including coal and natural gas. | |||

There are areas of the country, however, where wind’s LCOE values are lower or almost identical to those of advanced natural gas. Advanced natural gas, EIA analyst Sukunta Manussawee explained over email, is the only type of natural gas plant the agency expects to be built in the future, and refers to more efficient plants that get more energy from a given amount of fuel.

EIA provided us with more detailed regional LCOE data, which show that new wind is expected to be cheaper than new natural gas in two regions, and only one cent per megawatt more in a third. Collectively, these areas (regions 4, 17 and 22 on the map) cover a large swath of the country that stretches from Minnesota and the Dakotas down to Colorado and Kansas — places where wind speeds are highest over U.S. land.

Overall, then, the data suggest that based on LCOE, building a new onshore wind facility is already, or very soon will be, cheaper than building a new natural gas plant, either on average, or in large sections of the country, without federal dollars being thrown wind’s way.

That isn’t the case for offshore wind, which remains very expensive to build, and thus is more pricey per megawatt hour than most other sources, even after subsidies are included (see, for example Table 1a or Lazard’s unsubsidized estimate of $92/MWh). There is only one commercial offshore wind farm currently operating in the U.S.

Beyond Levelized Cost

While LCOE is the most frequently used metric for cost competitiveness, it’s not perfect.

The EIA in particular cautions against reading too much into LCOE. “LCOE does not capture all of the factors that contribute to actual investment decisions, making the direct comparison of LCOE across technologies problematic and misleading as a method to assess the economic competitiveness of various generation alternatives,” the agency’s February 2019 report reads.

This is especially true, the EIA says, when comparing intermittent renewables, such as wind and solar, to traditional sources. The main problem is that LCOE accounts for costs, but it ignores the other side of the equation: how much providers get paid for the electricity they produce, or the value of that electricity.

Because the sun doesn’t always shine and the wind doesn’t always blow, most wind and solar sources are not considered dispatchable, or available on-demand. This can make them less valuable to the grid.

The price of electricity also isn’t constant. It fluctuates throughout the day and seasonally in response to supply and demand in a given region.

Wind, for example, tends to be more abundant in mornings and evenings, as well as in spring and winter, when demand — and the wholesale price of electricity — is usually lower. Solar, on the other hand, peaks during the day, when demand is highest, so its value can be higher.

But the pricing dynamics can also change depending on how many other turbines or solar panels in an area are providing power.

As Bartlett explained, if an area with many renewables floods the system with energy at a specific time, as might happen at noontime with a bunch of solar — that can make prices plummet, and decrease the value of adding more of that type of energy.

“You’re eating your own lunch,” he said of solar providers in this scenario. “The more solar you put on, you’re eroding the prices you receive.” While this can apply to wind as well, Bartlett said it’s less of an issue because wind doesn’t have the same concentrated energy profile.

Another criticism of LCOE is that it doesn’t include all the costs to the system of generating electricity, such as integration costs, which may be higher for intermittent renewables such as wind and solar.

Accounting for Value

To assess the value — and not just cost — of electricity, the EIA has suggested another metric called levelized avoided cost of electricity, or LACE. LACE, the EIA says, is “a measure of what it would cost to generate the electricity that would be displaced by a new generation project,” thus providing a rough idea of how much revenue a plant could expect.

The agency proposes using LACE and LCOE together as a value-to-cost ratio, where anything above 1 indicates a project would make a profit.

According to data provided to us, five regions of the country are expected to have higher value-to-cost ratios for wind compared with natural gas in 2021. That, however, includes subsidies.

When we used unsubsidized LCOE numbers instead, no regions best gas — although region 17, or what is essentially Kansas, is very close (0.88 vs. 0.86). The agency, though, doesn’t normally calculate the ratios without subsidies because that doesn’t reflect what gets built.

Other groups, including the International Energy Agency, also recognize the problem with relying solely on LCOE. The IEA recently created a new metric for its 2018 World Energy Outlook report called value-adjusted levelized cost of electricity, or VALCOE, which also attempts to account for the value of different forms of energy.

Dan Shreve, the head of global wind energy research at the energy consultancy group Wood Mackenzie, said that he uses an extra indicator called net cost of new entry, or Net CONE. It’s an estimate of the costs of construction minus the electricity sales and other revenues over the first year.

“You can build oodles of wind, but if power prices are depressed, is that project going to make money over time?” Shreve asked. Net CONE helps adjust for that situation so developers can have a more realistic expectation of potential profits.

Still, Shreve thinks LCOE is valuable, even if it’s not the end all, be all. “Currently, in terms of where we are with relatively low penetration of renewables,” he said, “it still works fairly well.” As renewable penetration increases, new metrics will be needed, he said.

Projections

A third way of answering the cost-competitiveness question is to use the fact that wind’s main federal subsidy is sunsetting, and look at projections for what will happen once it’s gone.

If wind doesn’t “work” without subsidies, then one wouldn’t expect many new wind farms post-2023, which is when the last farms qualifying for the PTC would be put into service. But if wind doesn’t need the subsidy, turbines should keep popping up.

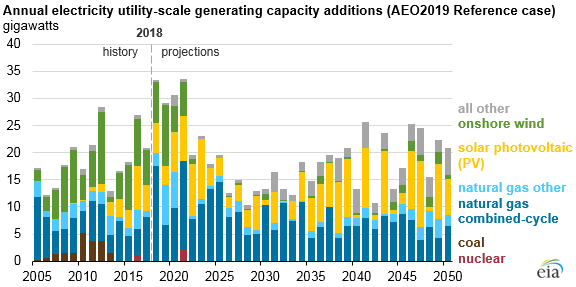

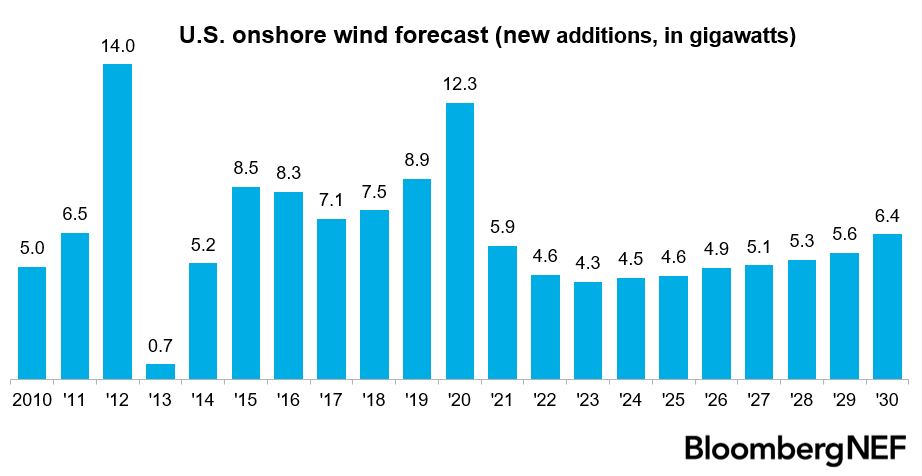

According to EIA’s modeling, which assumes existing policies are in place in the future, few new turbines are added after 2023 until around 2045 (see page 93). “New wind capacity additions continue at much lower levels after production tax credits expire in the early 2020s,” the agency’s 2019 Annual Energy Outlook report reads.

When we contacted the EIA, Chris Namovicz, the team leader for renewable electricity analysis, pointed out that part of what the forecast is capturing is the effect of the current subsidy moving up construction of projects that otherwise would have happened a bit later. This reduces the number of projects projected after 2023.

“What we see is not that wind is non-competitive without the PTC,” he explained in an email, “but rather that with the PTC it is very competitive.”

But Barlett, the expert with Resources for the Future, said that given there are so few projected additions — a total of just 5 gigawatts between 2022 and 2040 — the agency does seem to be projecting limited competitiveness for wind after the PTC expires.

On the basis of the EIA forecast, Bartlett said, Trump is “not completely wrong.”

Not everyone, however, agrees with the EIA’s projections. BloombergNEF, for example, shared its forecast with us and projects that in every year between 2023 and 2030, the country will add at least 4.3 gigawatts of onshore wind.

Shreve of Wood Mackenzie also disagreed with the EIA, and noted that most of the major consultancy groups that work on renewable forecasting do as well. He said he believed there would be a “robust market” for both onshore and offshore wind over the next decade.

Nevertheless, he acknowledged how complicated the question of wind’s cost-competitiveness is when looking beyond simple metrics. “That question is best answered in a very long research report, and even then there will be debate,” he told us over email.

In the end, only time will tell whether wind is viable without subsidies. As Namovicz emphasized in a phone interview, despite all the numbers and fancy analytics that people try to use, because the U.S. is currently providing a large subsidy to wind, it’s impossible to know the alternative.

“There are no facts without the subsidy, because we don’t have that data available,” he said. “Everything else is just analysis and economic modeling.”

It’s a sentiment that Murray, the Duke economist, also shared. “Basically the tax credit played its role,” he said in an email. “That is how subsidies are supposed to work — kick start a technology and see if it can compete. Looks like we will see.”

FactCheck.org Rating:

FactCheck.org Rating: